Managing Formulary Changes: How to Handle Prescription Drug Coverage Updates

Dec, 26 2025

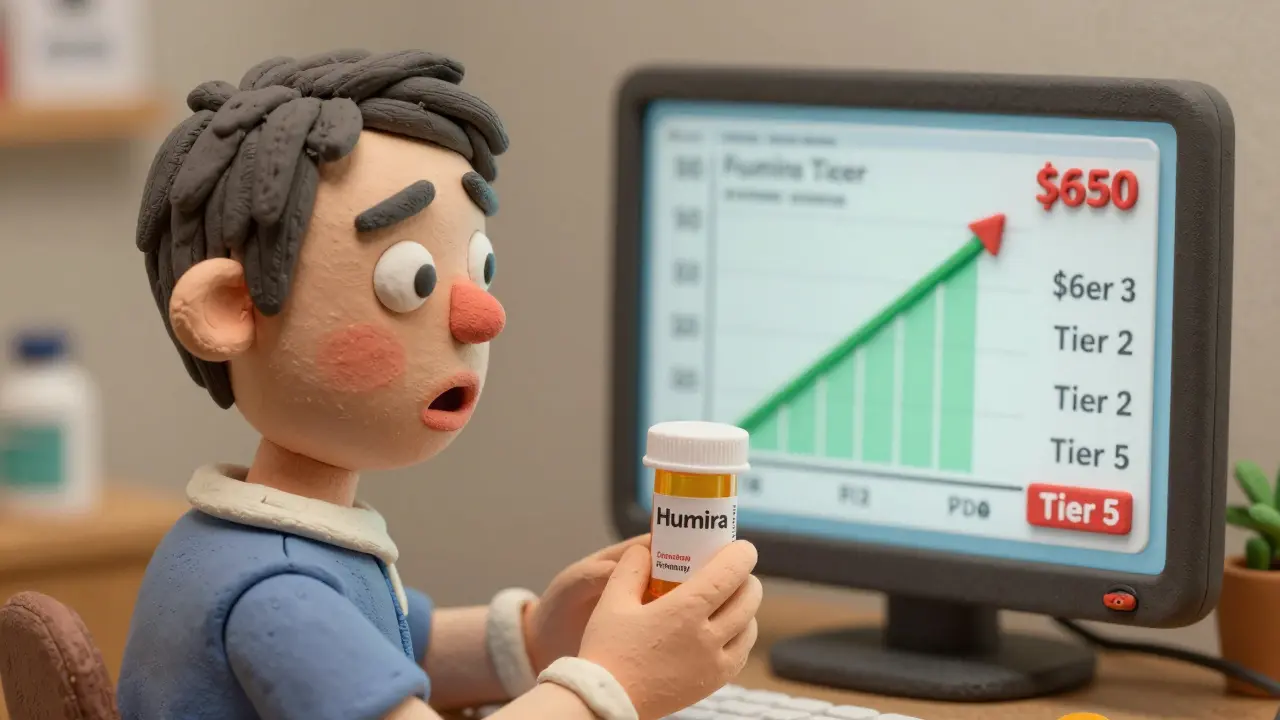

When your insurance plan suddenly stops covering your medication, it’s not just a paperwork issue-it’s a health crisis. Imagine taking Humira for Crohn’s disease for seven years, then one day your monthly cost jumps from $50 to $650 because your plan moved it to a higher tier. That’s not hypothetical. It happened to real people in 2024, and thousands more face similar shocks every year. Formulary changes aren’t rare events. They’re routine, predictable, and often poorly communicated. If you’re on chronic medication, knowing how to handle these updates isn’t optional-it’s essential.

What Exactly Is a Formulary?

A formulary is a list of prescription drugs your insurance plan agrees to cover. It’s not just a catalog. It’s a tool used by insurers to control costs and steer patients toward medications they consider cost-effective. Most formularies are tiered: Tier 1 has generic drugs with the lowest copay, Tier 2 has preferred brand-name drugs, Tier 3 has non-preferred brands, and Tier 4 or 5 (specialty tier) includes high-cost drugs like biologics for cancer or autoimmune diseases. Medicare Part D plans typically have six tiers, with coinsurance reaching 33% on the highest tier. Commercial plans vary more, but 92% of Medicare and 87% of commercial plans use some version of this tiered structure.Why Do Formularies Change?

Formularies aren’t set in stone. They’re reviewed at least quarterly by Pharmacy and Therapeutics (P&T) committees-groups of doctors, pharmacists, and sometimes patient advocates-who evaluate new drugs, negotiate rebates with manufacturers, and assess cost-effectiveness. A drug might be removed because a cheaper generic became available, or because a new study showed it’s less effective than alternatives. Sometimes, it’s just about money: if a manufacturer stops offering a good rebate, the insurer drops the drug to save cash. In 2024, 78% of large pharmacy benefit managers (PBMs) conducted quarterly reviews. That means your drug could be moved, restricted, or dropped at any time. Medicare Part D plans are required to notify beneficiaries 60 days in advance for non-urgent changes. Commercial plans? Often only 22 days. And 57% of patients say they got no meaningful warning at all.How Formulary Changes Hit Patients

The impact isn’t just financial. When a drug moves from Tier 2 to Tier 3, abandonment rates jump 47%. For diabetes medications, that number hits 58%. People stop taking their meds-not because they don’t want to, but because they can’t afford it. A 2023 Scripta Insights report found that 22% of patients become non-adherent after a formulary change. And it’s not just about out-of-pocket costs. Some drugs require prior authorization, step therapy, or quantity limits. One patient described being forced to try four cheaper drugs before being allowed to return to their original one. That’s not just inconvenient-it’s dangerous. For chronic conditions like hypertension or rheumatoid arthritis, where multiple treatment options exist, formularies work reasonably well. But for rare diseases? 73% of specialty drugs now require prior authorization. If your only effective treatment gets dropped, you’re stuck in a bureaucratic maze.

What You Can Do When Your Drug Is Removed

You’re not powerless. Here’s what to do when your medication is affected:- Check your plan’s formulary-before and after enrollment. Don’t wait for a letter. Use your insurer’s online formulary lookup tool. Nearly 92% of insurers offer one.

- Ask for a formulary exception. If your doctor says the drug is medically necessary, you can request an exception. CMS data shows 64% of these requests are approved when backed by clinical evidence. Your doctor must submit a letter explaining why alternatives won’t work.

- Request a transition supply. If your drug is being removed, you’re often entitled to a 30- to 60-day supply while you appeal or switch. Medicare requires this. Many commercial plans do too.

- Use manufacturer assistance programs. Companies like AbbVie (Humira) and Roche (Enbrel) offer copay cards or free drug programs. In 2024, these programs covered $6.2 billion in patient costs.

- Switch to a therapeutic alternative. Ask your doctor if another drug in the same class works. For example, if one TNF inhibitor is dropped, another might be covered.

- Call your State Health Insurance Assistance Program (SHIP). Medicare beneficiaries who used SHIP for help with exceptions had a 37% higher success rate.

How Providers Can Prevent Disruptions

Doctors and clinics aren’t just bystanders. They’re frontline defenders. Large medical groups using e-prescribing systems that check formulary status in real-time reduced patient disruptions by 68%. That means when a doctor writes a prescription, the system flags if it’s covered, requires prior auth, or is being removed. If your provider doesn’t do this, ask them to. It’s not just better for you-it’s better for their practice.What’s Changing in 2025

The rules are shifting. The Inflation Reduction Act caps out-of-pocket drug costs for Medicare beneficiaries at $2,000 per year starting in 2025. That’s going to force insurers to rethink how they structure tiers. Drugs that were once pushed to high-cost tiers might move back down to keep patients from hitting the cap. Also, CMS is requiring all Medicare Part D plans to standardize their formulary exception criteria by 2025. That means less confusion, more consistency. And insurers are starting to use AI to predict how formulary changes affect patient adherence-with 89% accuracy in early trials. Value-based formularies, which reward drugs based on real-world outcomes rather than just price, are growing fast. In 2024, they were used by 25% of large employers. By 2027, that number could hit 45%. These systems might mean fewer sudden drops-if a drug works well for patients, it stays on the list.

How to Stay Ahead

Don’t wait for a surprise. Make formulary checks part of your annual routine:- Review your formulary every fall during Open Enrollment.

- Check after major life events: marriage, job change, moving to a new state.

- Save your plan’s customer service number and formulary lookup link in your phone.

- Ask your pharmacist to flag any upcoming changes when you refill.

Why This Matters Beyond Your Wallet

Formularies aren’t just about cost-they’re about access. When patients can’t afford their meds, ER visits go up. Hospitalizations climb. Long-term health declines. One study found that formulary exclusions cost patients an average of $587 extra per year. But the real cost? Lost time, missed work, worsening disease, and preventable suffering. The system isn’t broken-it’s designed to save money. But it’s failing when it sacrifices health for savings. You have rights. You have tools. You have a voice. Use them.What should I do if my medication is removed from my insurance formulary?

First, confirm the change by checking your insurer’s online formulary tool. Then, ask your doctor to file a formulary exception request with clinical justification. You may also be eligible for a 30- to 60-day transition supply. Explore manufacturer assistance programs and ask about therapeutic alternatives. If you’re on Medicare, contact your State Health Insurance Assistance Program (SHIP) for free counseling.

How much notice am I supposed to get before a formulary change?

Medicare Part D plans must give you 60 days’ notice for non-urgent changes. Commercial plans are not federally required to give any minimum notice, but many provide 22 to 30 days on average. Always check your plan documents and sign up for email alerts. If you’re not notified, you still have the right to request a transition supply and file an exception.

Can I switch plans if my drug gets dropped?

Outside of Open Enrollment, you can’t switch Medicare Part D plans unless you qualify for a Special Enrollment Period-like moving to a new state or losing other coverage. For commercial plans, you usually have to wait until your next enrollment period unless you experience a qualifying life event. In the meantime, use exceptions, transition supplies, or manufacturer assistance to bridge the gap.

Why do some drugs get removed while others stay?

Drugs are removed based on cost, clinical evidence, and rebate deals. If a generic version becomes available, or if a competitor offers a better rebate to the insurer, the original drug may be moved to a higher tier or dropped entirely. Drugs with strong real-world outcomes or limited alternatives are more likely to stay. For example, insulin and certain cancer drugs rarely get removed because few alternatives exist.

Are there drugs that are always covered, no matter what?

Medicare Part D plans must cover at least two drugs in each therapeutic class and include all drugs in certain protected categories like antiretrovirals, antidepressants, and immunosuppressants. Commercial plans have more flexibility, but most still cover essential medications for chronic conditions. Still, even protected drugs can be moved to higher tiers with higher costs.

How can I find out if my drug is on a formulary before I start taking it?

Always check your plan’s formulary online before filling a new prescription. Use tools like Medicare’s Plan Finder or your insurer’s formulary lookup. Ask your doctor’s office if they use real-time formulary checks in their e-prescribing system. If you’re switching plans, compare formularies during Open Enrollment. Don’t assume your current drug will be covered-always verify.